State of the Union 2023

In my 20-year real estate investment management career, I have been fortunate enough to lead a team who has overseen over $2 billion of gross sales volume, completed over 30,000 renovations/builds, and leased/managed over 20,000 doors.

The past five years have undoubtedly been by far the most turbulent times, including the most dynamic real estate market cycle shifts I have ever experienced:

- Pre-pandemic, historically low interest rates led to frenzied buying and selling, particularly in the burgeoning SFR/BFR asset classes

- Covid lack of production and supply chain issues placed even more strain on a supply-depleted system while buying/selling and strong rental activity increased significantly—particularly among single family rentals, build-for-rent communities, and small multifamily assets in Southeastern growth markets

- Post-Covid the pace and volume continued as additional pent-up relocation demand was released into growing markets (See link below)

- Also post-Covid institutional aggregators doubled down on SFR/BFR. This was largely based on how it weathered the pandemic downturn compared to other more traditionally strong, recession-resistant asset classes (office, retail). Again this activity was particularly sharp in Southeastern growth markets

Pre-Covid, the lingering question for large SFR/BFR owners/operators was always: How will these new (SFR/BFR) asset classes perform in a down market? Because SFR was essentially created on the heels of the last financial collapse in 2008, Covid was the asset classes’ first test. And SFR/BFR answered the bell with uniform strength—even rental income delinquencies were a lot less significant/costly than initially feared.

So as we sit on the edge of a new year and a still-shifting market cycle, we feel extremely fortunate to be heavily invested and operating in the SFR/BFR space and sector. As the New York Times discusses, the future looks like lots of renters.

Auben’s focus has always been on workforce housing, B and C class assets in working class neighborhoods. We feel confident this sub-sector middle market will out-perform Class A and lower income assets (class D) which we expect (at minimum) to be squeezed by current market conditions.

Auben’s existing geographic footprint in extremely strong and stable Southeastern secondary (Chattanooga/Greenville) and tertiary (Augusta/Columbia) markets, and our entry into primary markets (Charlotte/Atlanta/Jacksonville)—to capitalize on existing and upcoming distress—gives us even more confidence that we will weather any upcoming headwinds much better than most asset classes, markets and owner/operators.

And migration continues to be strong in the Southeast.

We are very thankful to be where we are, doing what we are doing. However, it’s not all roses.

The pace of the frenetic buying and selling activity has undoubtedly shifted significantly over the past 18 months, as the Federal Reserve has dramatically raised interest rates to cool inflation.

We saw the change initially in some of our institutional client relationships, where buying (based on their cost of debt and capital) ground to a halt in Q3 and Q4 last year. This inactivity has persisted with current, active institutional buyers being extremely market (primary) and asset type (BFR) selective.

However, even with the sales landscape changing dramatically, we see an opportunity. We have been able to parlay some of our longstanding institutional relationships into strong disposition partnerships, which are ironically returning homes to homeowners who couldn’t compete with the same institutional capital machines a couple of years ago.

Over the past six months, we have seen the sales acquisition slow-down migrate from institutional investors, to local investors, and now even to owner-occupants. Needless to say in the 2024 projections of our vertically integrated model, we have definitely adjusted down our investor sales acquisition projections.

Thankfully, we believe a lot of this activity will translate to increased rental demand for our clients. We believe this, because we have seen it before.

Auben Realty, the Southeast’s first full-service SFR investment brokerage, was formed in Augusta, GA in the fall of 2009. And while most of the overall market (locally and nationally) was struggling, we were growing at a breakneck speed, doubling in size every year with strictly organic growth.

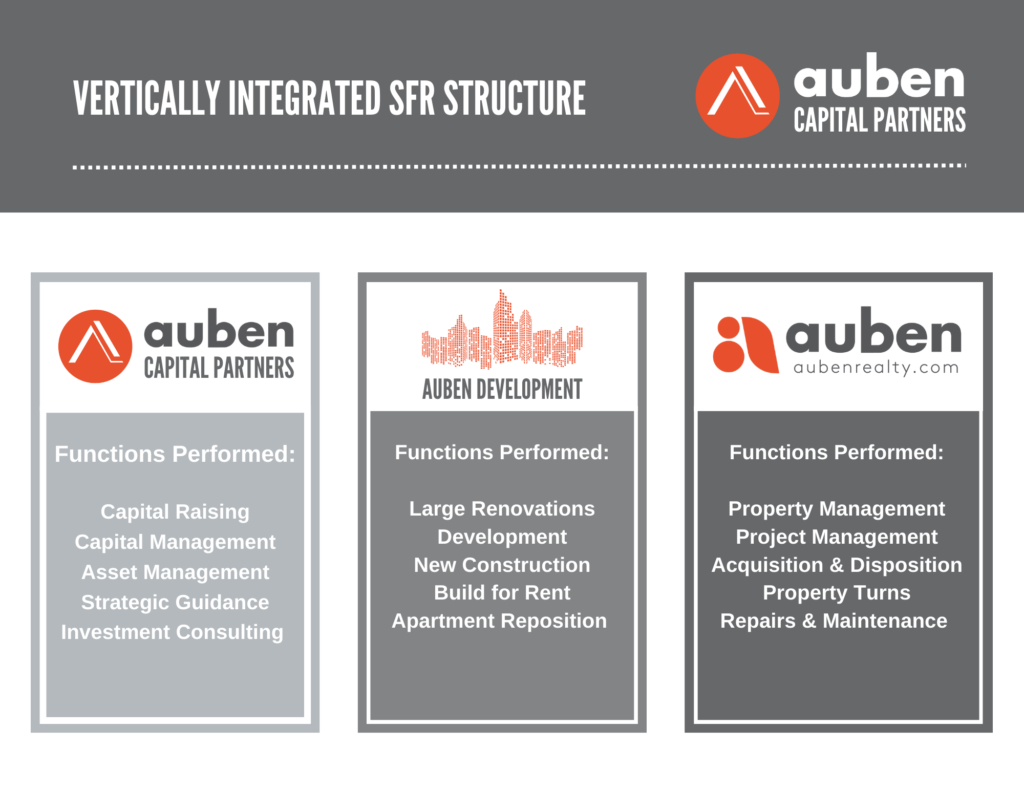

We are uncertain times will be the same. However, we believe there is a unique opportunity to run fast while markets and other owners/operators are frozen. The current plan and structure we will be launching on 1/1/2024 is two years in the making. It started with dramatic new hiring of extremely seasoned and experienced individuals like Cole Thompson, Donald Caster, and Thom Liggett. And the change is culminating in the creation and formation of two new divisions of Auben launching January 1, 2024: Auben Capital Partners and Auben Development.

These new entities will allow us to better capitalize on existing opportunities, while also pursuing new ones. Our first new opportunity is an investment acquisition fund targeting the purchase of investor-focused property management brokerages.

If you would like to schedule a time to discuss the market or this upcoming investment with me, please use the link below

This offering will be made first and foremost to our existing ecosystem investors (and their contacts), Auben team members, and other friends and family. Then the investment will be offered to a wider range of small institutional investors, family offices and accredited investors.

We can’t wait to show you what we have in store in 2024.

If you would like to stay up-to-date with the shifting real estate market, please subscribe to my weekly LinkedIn newsletter!